MICROSERFIN | Microfinance Institution

Microserfin, a leading microfinance institution that is part of the BBVA Microfinance Foundation, focuses on financial inclusion of the most vulnerable microentrepreneurs in Panama. The institution offers productive loans, as well as microinsurance, financial literacy, technical assistance and health services.

Microserfin is a pioneer in providing agricultural loans in Panama, being the only relevant player with a product that serves small farmers through a methodology adapted to productive cycles. The institution is in the process of refining and digitising the agricultural lending methodology, including a significant improvement in risk management.

Microserfin is working on the development of an environmental policy based on the Group’s experience. In 2020, the MFI started measuring carbon footprint (with 0.34 CO2 emission by employee), currently focusing on improving highest environmental impact related to Marketing & Client Experience areas.

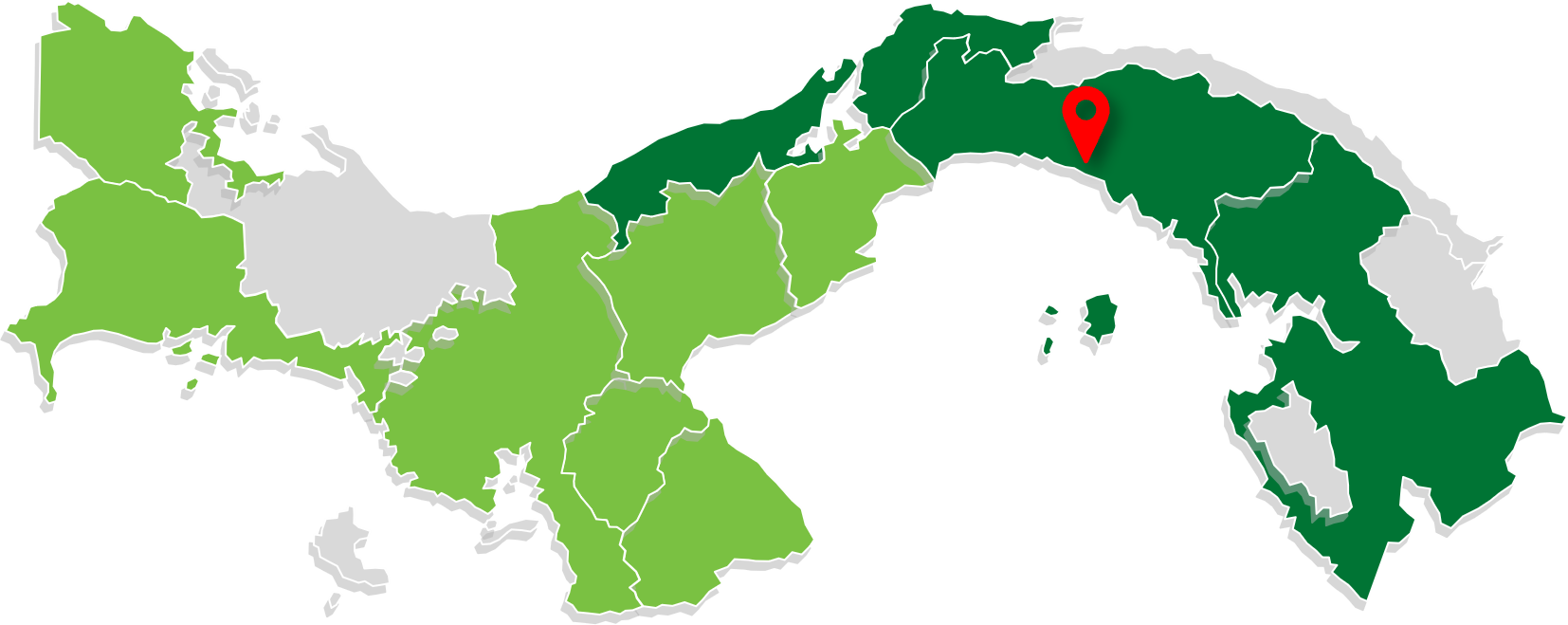

Country: Panama

Inversión: EUR 2 million

Investment type: Senior unsecured debt

Technical assistance: Pending confirmation

Date of investment: December 2021